Heart of HF1 is business tax credits

The House Republican majority’s marquee bill of the session received its first public airing Thursday in the House Greater Minnesota Economic and Workforce Development Policy Committee.

HF1 - a smorgasbord of proposed regulatory law changes, tax breaks for business, and rural workforce housing incentives - was laid over following testimony from a number of business and Greater Minnesota interest groups.

The bill’s sponsor, Rep. Ron Kresha (R-Little Falls), emphasized that its varied provisions are still a work in progress. “What we have is a broad agreement on many of these concepts,” he said. “I would invite the committee members to help me move this forward and fix some of these areas.”

[WATCH: Full video of Thursday's hearing]

The heart of HF1 involves a number of business tax credits. One would create a “new markets” tax credit in four targeted sectors: manufacturing, mining, timber and high tech. The bill would authorize the Department of Employment and Economic Development to certify $250 million in qualifying investments, at a potential cost in lost revenue of up to $97.5 million. However, given the proposed 2017 launch of the program, none of those costs would fall in the upcoming 2016-17 biennium.

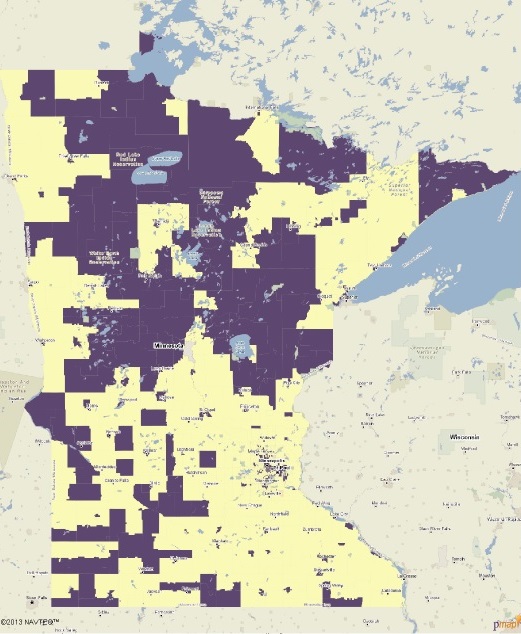

A map of Minnesota census tracts included in committee materials [see graphic below] underscored the potential regional impact of the new markets credit: More than half the territory in the central and northern portions of the state would be eligible for the credit under the proposed bill, as would many of the counties in southwestern Minnesota.

Other tax provisions of the bill would:

- make 10 percent of pass-through income from S-corporations, partnerships and LLCs subtractable for purposes of calculating taxable income;

- modify the state’s existing research and development tax credit program to make up to $200,000 of the credit refundable and to expand the credit rate on investments over $2 million from 2.5 percent to 4 percent; and

- offer refundable income tax credits to people who take jobs in science, technology, engineering or mathematics (STEM) or in long-term care work in qualified economic development zones.

In rolling out the bill earlier this month, House Republican leaders estimated the cost of its tax provisions at $250 million in the next biennium, but detailed fiscal estimates have yet to be prepared. Preliminary estimates by House fiscal staff have put the cost of the 10 percent income pass-through provision at $160 million for the biennium, and the cost of making the Rand D credit refundable at $40 million.

Rural workforce housing

HF1 contains a pair of proposed incentives aimed at addressing a chronic shortage of workforce housing in Greater Minnesota. One would establish a $5 million DEED grant program to help cities fund the development of market-rate rental housing; the other would offer a refundable credit to businesses with at least 25 employees that make contributions to land trusts for acquiring property for the development of rental housing in qualified cities.

Potential impact of "new markets" tax credit. Graphic by PolicyMap, courtesy House Greater Minnesota Economic and Workforce Development Policy Committee

Potential impact of "new markets" tax credit. Graphic by PolicyMap, courtesy House Greater Minnesota Economic and Workforce Development Policy CommitteeKresha called it a “critical” part of the bill. “I can’t think of many conversations, when I talk [with Greater Minnesota businesses] about jobs, that haven’t involved workforce housing development,” he said.

That priority was echoed by testifiers from the League of Minnesota Cities and the Greater Minnesota Partnership. Patrick Hynes, intergovernmental relations director of LMC, noted that many cities in rural parts of the state have been paralyzed in their efforts to encourage market-rate rental developments by a structural gap between local prevailing rents and the level of rents required to make those developments feasible.

Hynes cited the experience of the City of Roseau, which received state money under a pilot project to subsidize the construction of 30 units of market-rate rental housing. Private developers had refused to touch the project, he said, because average rents in the city are $500-$600 a month, or about half the monthly rates required to give the project adequate cash flow for private financing.

Regulatory law changes

Among its proposed changes to the state’s regulatory apparatus, HF1 would reduce the goal for responding to non-complicated, “Tier 1” environmental permit applications from 90 days to 45.

It would also modify the law regarding state agency rulemaking in a couple of ways. The bill seeks to vest sole authority to object to proposed rules in the Legislative Coordinating Commission, and it would expand the grounds for objecting to proposed rules to include potentially adverse economic impacts, undue burdens on business, or greater restrictiveness than contained in federal law.

Rep. Tim Mahoney (DFL-St. Paul) sounded one of the hearing’s few disparaging notes, warning his Greater Minnesota colleagues about the consequences of what he called “this continued watering down of regulations and review.

“Maybe you can exempt the urban area – please?” he said. “I’ve been on this committee for 16 years, and I’ve been fighting tooth and nail to get brownfield clean-up money” to remediate environmental messes left by defunct businesses in his district.

“The more you loosen these regulations,” Mahoney said, “the more problems you will have.”

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Ways and Means Committee OKs proposed $512 million supplemental budget on party-line vote

By Mike Cook Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Minnesota’s projected budget surplus balloons to $3.7 billion, but fiscal pressure still looms

By Rob Hubbard Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...

Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...