New soccer stadium seen as way to revitalize ‘underutilized’ area

Major redevelopment of St. Paul’s Midway district could be a byproduct of a new Major League Soccer stadium in the area near Snelling and University avenues, just north of Interstate 94.

However, stadium developers say that in order for the numbers to work and the stadium project to move forward, they need a permanent property tax exemption along with a sales tax exemption on construction materials that would be used to build the 20,000-seat stadium.

“This will be the very catalyst for redevelopment in an underutilized area and will increase the taxable value to 13 times over its current value,” St. Paul Mayor Chris Coleman told the House Property Tax and Local Government Finance Division Wednesday. His comments came during discussion of HF3806, which would provide the tax breaks. Absent the tax exemption, he said the redevelopment would not happen.

“We think this is an exciting opportunity to revitalize a part of the city that is called Midway for a reason – it’s really the center of the population base – its’ smack dab in the middle of the bulls eye,” he said.

Soccer fans Casey Krolczyk of Minneapolis, left, Tristan Rholl of Northfield, right, and Teresa Petersen of Blaine listen to April 13 testimony before the House Property Tax and Local Government Finance Division about HF3806. Photo by Paul Battaglia

Soccer fans Casey Krolczyk of Minneapolis, left, Tristan Rholl of Northfield, right, and Teresa Petersen of Blaine listen to April 13 testimony before the House Property Tax and Local Government Finance Division about HF3806. Photo by Paul BattagliaArea redevelopment could include a theater, retail restaurants and bars, offices and housing.

Sponsored by Rep. Tim Sanders (R-Blaine), the bill was held over in committee; however, an information-only hearing is scheduled in Thursday’s House Taxes Committee.

Coleman said the property, often referred to as the “Bus Barn site,” is currently owned by the Metropolitan Council and the mostly vacant land is used as a storage area.

“This is the first time that a stadium proposal would be privately funded. The area has been dreadfully underused and off the tax rolls for 50 years,” he said.

But the redevelopment could mean higher property taxes for small-businesses located in the area that are recovering from the impact of years of light-rail construction.

LISTEN Full archived audio of the hearing

That is a concern to several House members.

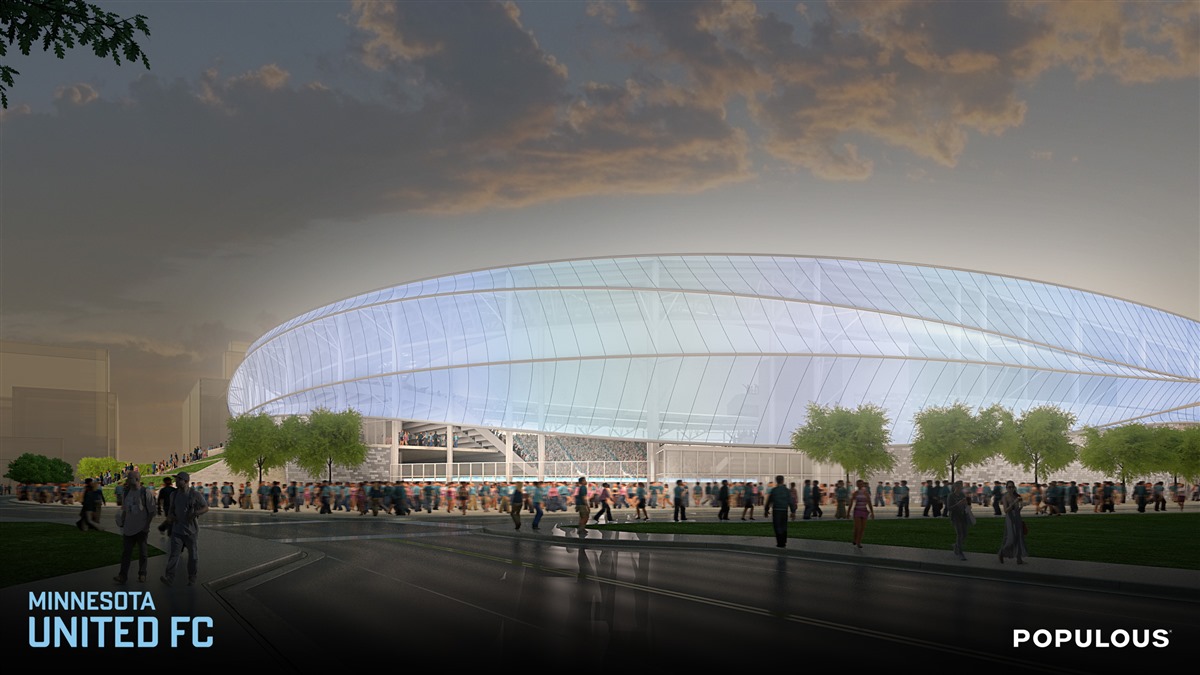

A rendering of the proposed soccer stadium. Image courtesy Minnesota United FC/Populous

A rendering of the proposed soccer stadium. Image courtesy Minnesota United FC/PopulousRep. Joe McDonald (R-Delano) said that the new stadium could force some businesses out. ‘I’m just concerned that for those ma and pa small businesses, their taxable value will go up significantly while this project gets a top property tax exemption. … just food for thought.”

Rep. Rena Moran (DFL-St. Paul), who represents the area, acknowledged the possible tax the project could impose on surrounding small businesses, but noted that “there is a window of opportunity” for others – including more customer traffic.

Stadium construction is to be paid for by a group of investors headed by Dr. Bill McGuire, who owns Minnesota United FC, and upon completion, turned over to the City of St. Paul. Ongoing maintenance will be the team’s responsibility.

The bill would provide an upfront sales tax exemption for construction-related purchases by a contractor, subcontractor and builder as well as the owner. It would expire one year after the first Major League Soccer game is played in the stadium.

The bill also would exempt from property taxes the stadium and related facilities. The exemption would not apply to property under a lease or use agreement of property unrelated to the stadium. Legislative approval is needed for the exemption, because even though the stadium would be owned by the city, it would be for private use.

According to a Department of Revenue estimate, if the stadium is expected to cost around $150 million to build, sales tax, if charged, would add $3.5 million to the state’s General Fund in Fiscal Years 2017 and 2018.

The companion, SF3241, is sponsored by Senate President Sandra Pappas (DFL-St. Paul) and awaits action by the Senate Taxes Committee.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Ways and Means Committee OKs proposed $512 million supplemental budget on party-line vote

By Mike Cook Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Minnesota’s projected budget surplus balloons to $3.7 billion, but fiscal pressure still looms

By Rob Hubbard Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...

Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...