Focus put on elderly finance fraud

The opportunities come from seemingly everywhere: the Internet, a flyer in the mail, a phone call.

As America’s baby boomer population continues to age at an increasing rate, so does the number of thieves trying new ways to scam them out of their savings.

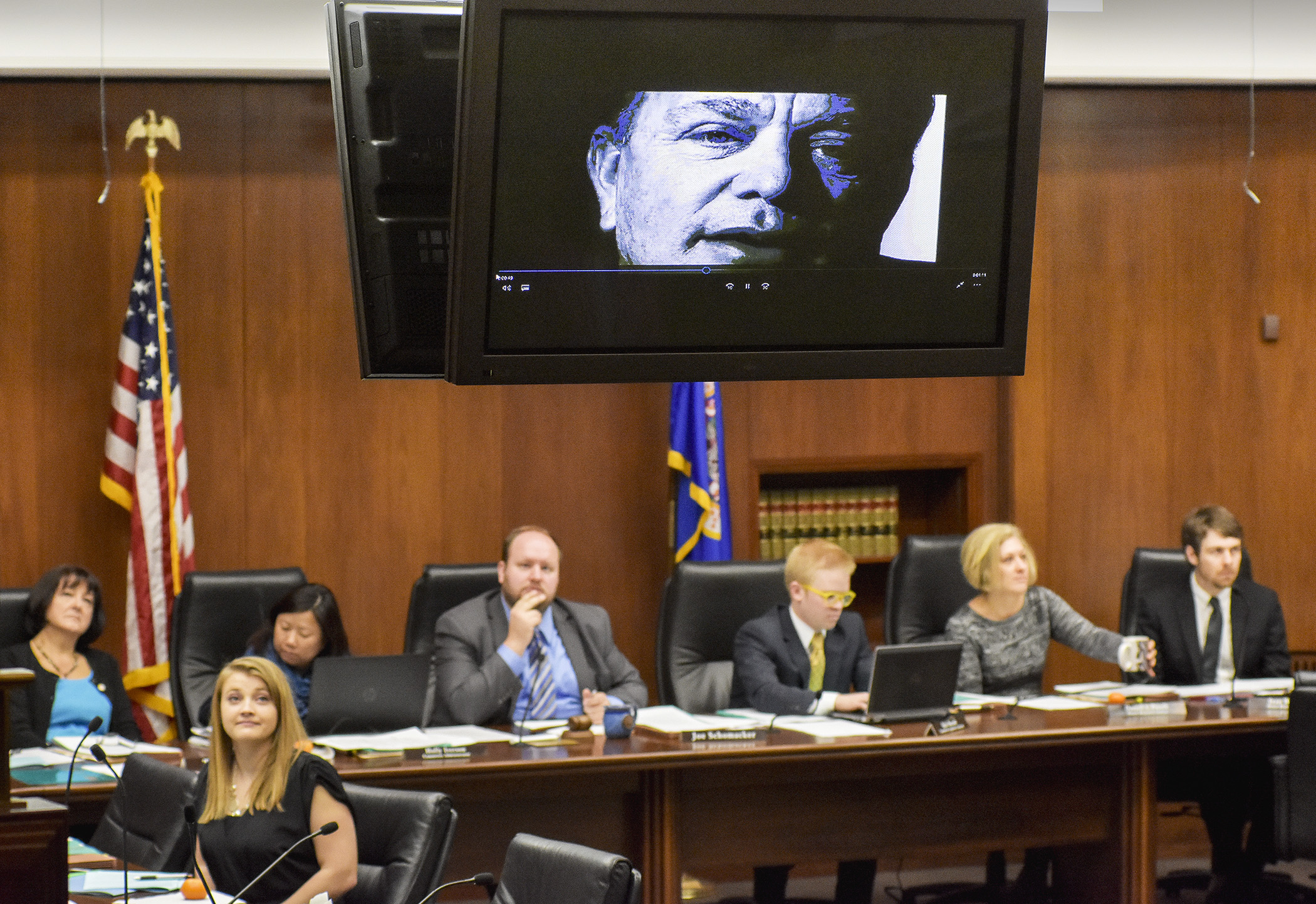

Education and outreach for those being the targets is the focus of HF3454, sponsored by Rep. Paul Rosenthal (DFL-Edina).

The bill would add $500,000 to the Commerce Department, beginning in fiscal year 2017, to implement a statewide campaign promoting the perils of those offering a “free lunch,” or other investments. Efforts would focus on vulnerable adults, and include radio and TV advertisements as well as door-to-door staff outreach. The program would have the potential to be renewed the following year.

Approved by the House Aging and Long-Term Care Policy Committee Wednesday, it now moves to the House Job Growth and Energy Affordability Policy and Finance Committee. A companion, SF3222, sponsored by Sen. John Hoffman (DFL-Champlin), awaits action by the Senate Commerce Committee.

Rosenthal detailed the inspiration behind the bill, citing his own mother being vulnerable to offers she has seen in the newspaper, and himself receiving calls offering to fix credit card debt he doesn’t have.

“This is a statewide problem, not just in the metro,” Rosenthal said. “We want to make this as broad of an outreach as possible, and make sure our seniors don’t get caught in these rampant scams.”

Commerce Commissioner Mike Rothman believes the proactive nature of the bill could benefit many Minnesotans.

“We are only seeing the tip of the iceberg of fraudulent claims that are actually being reported; the threat will only continue to grow,” Rothman said. “We want to get to the airwaves to educate people before it happens; tell them to ask questions before they invest. We want to do everything we can to stay ahead [of criminals].”

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Ways and Means Committee OKs proposed $512 million supplemental budget on party-line vote

By Mike Cook Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Minnesota’s projected budget surplus balloons to $3.7 billion, but fiscal pressure still looms

By Rob Hubbard Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...

Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...