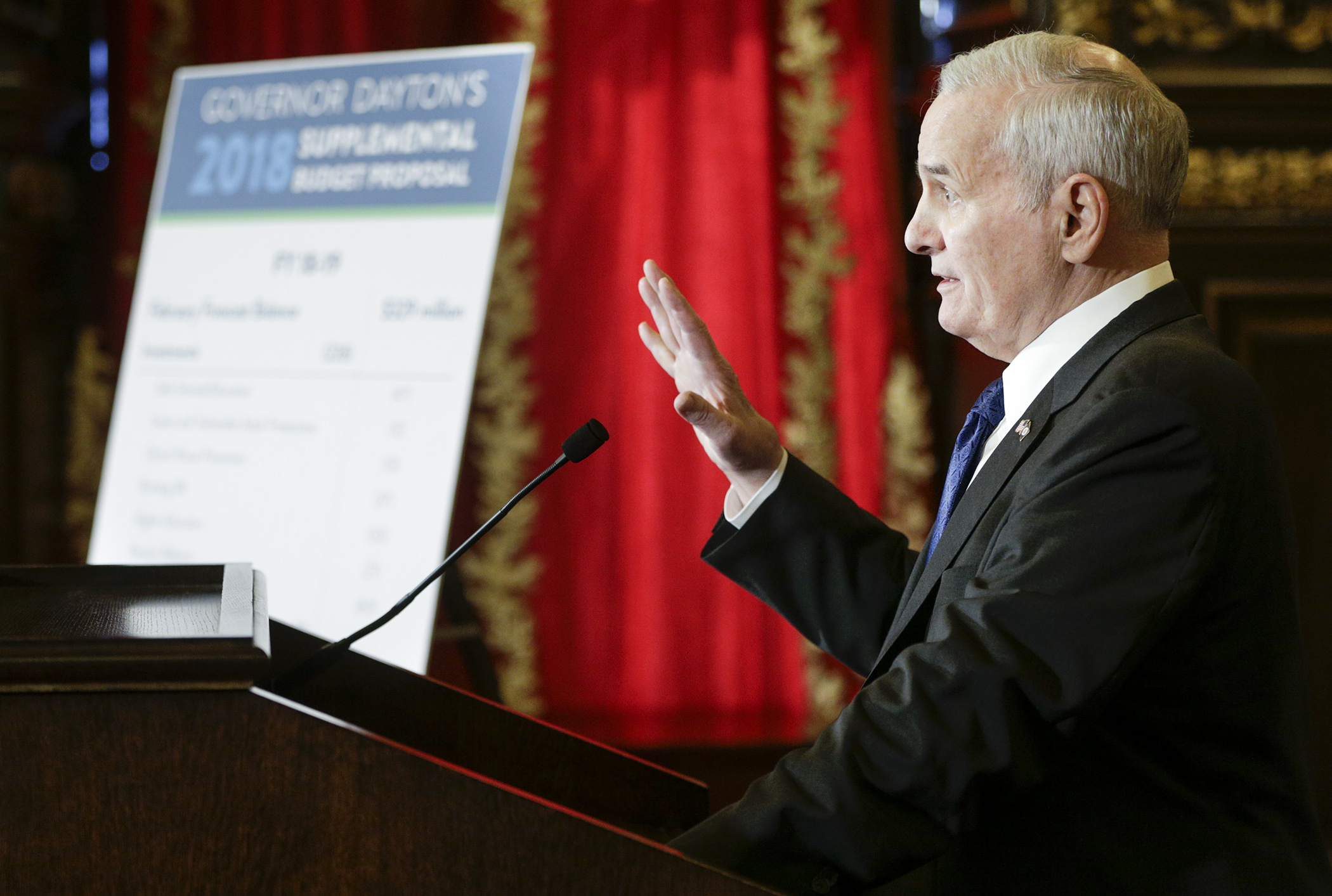

Dayton’s supplemental budget spends $226 million on MNLARS, school safety, broadband and more

In his final budget adjustments, Gov. Mark Dayton on Friday announced he would spend $226 million of the state’s projected $329 million surplus, with an emphasis on school safety and education, transportation infrastructure, expanding broadband and altering taxes to conform to recent changes in federal law.

Dayton’s plan, which he called “almost revenue neutral,” centers on the federal Tax Cuts and Jobs Act of 2017 and then hinges on many of the governor’s top priorities. “I’m going to warn you in advance,” he said. “This is complicated.”

The governor’s plan includes $20 million in revenue changes – taxes – by reinstating business and industrial property taxes, restoring tobacco and premium cigar taxes, adding new taxes to exempt data centers and ending certain corporate tax reliefs afforded in the federal code. Dayton pitched expanding the Working Family Tax Credit and separating the state income tax system from the federal government’s system by using adjusted gross income instead of federal taxable income – a change that would give 1.9 million Minnesotans an average of $117 in tax relief.

The supplemental budget proposes spending:

- $30 million on border-to-border broadband;

- $27 million for state employees’ pension system;

- $20.7 million on MNLARS, including $10.7 million on the system itself and $10 million to reimburse deputy registrars;

- $19.6 million for MN.IT to improve state data systems;

- $18.5 million for Minnesota State’s campus support and data systems;

- $16.9 million on special education;

- $15.8 million for school safety, plus an additional $5.2 million on school-related mental health grants;

- $10 million for tuition relief at the University of Minnesota;

- $9.1 million for Capitol Complex security upgrades; and

- $8.2 million on transportation-related repairs, mostly $5.4 million for Highway 53.

Dayton also proposes offering a MinnesotaCare buy-in, which would cost $58.3 million in the 2020-21 biennium.

After the February budget forecast projected a $329 million surplus, Dayton’s budget adjustments would leave $123 million unspent. The governor has used recent forecast reports and his State of the State speech to emphasize his administration’s efforts on fiscal stability.

“This is a supplemental budget of significant individual income tax cuts and modest spending increases,” Dayton said. “The No. 1 priorities are Minnesotans and their families. I look forward to working with the Legislature during the next two months to enact these measures.”

AUDIO Listen to Gov. Dayton’s news conference

Legislators react

Although Dayton, a DFLer, laid out priorities similar to those he highlighted in previous years, he will still have to work with the Republican-controlled Legislature. The 2018 session is constitutionally mandated to wrap-up by May 21.

“Governor Dayton’s plan is too complicated,” Senate Majority Leader Paul Gazelka (R-Nisswa) said in a news release. “It raises taxes. It doesn’t take responsibility for the failed DMV system, but increases fees to pay for it. It doesn’t take responsibility for elder abuse, but increases fees on nursing homes. It’s the wrong direction for Minnesota.”

VIDEO Watch Gov. Dayton's news conference on YouTube

Rep. Greg Davids (R-Preston), who chairs the House Taxes Committee, said shifting Minnesota from the federal taxable income model to adjusted gross income is a “step in the right direction.”

“In the coming weeks, we will unveil our tax conformity proposal; rather than using tax conformity to raise taxes on Minnesotans, Republicans will focus on holding Minnesotans harmless and preventing headaches for filers next year,” Davids said in a statement. “Lastly, the Governor knows that House Republicans do not plan on revisiting tax proposals he personally signed into law. It would be irresponsible to raise billions in taxes when we have a healthy budget surplus."

One of Dayton’s adjustments to fix MNLARS includes a $2 increase to driver’s license applications and registration renewals. Republicans said they refuse to entertain that idea.

“Governor Dayton has repeatedly claimed he is taking responsibility for the MNLARS mess his administration created,” said Rep. Paul Torkelson (R-Hanska), chair of the House Transportation Finance Committee. “Raising DMV fees on hardworking Minnesotans shows he is apparently not serious about backing up those words with action. This proposal is dead-on-arrival in the Minnesota House, and we will not force Minnesotans to pay more to clean up the governor's DMV mess."

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Ways and Means Committee OKs proposed $512 million supplemental budget on party-line vote

By Mike Cook Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Minnesota’s projected budget surplus balloons to $3.7 billion, but fiscal pressure still looms

By Rob Hubbard Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...

Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...