Dear Neighbors,

Last week I was able to visit 13 of the 45 block parties being held in South St. Paul for National Night Out/Night to Unite. I was proud to visit with neighbors and meet with local law enforcement officers and first responders.

I also attended an event celebrating the groundbreaking for the Veterans Memorial Greenway in Dakota County alongside my fellow state legislators, Senator Amy Klobuchar, and Representative Angie Craig! This trail will link Lebanon Hills Regional Park and the Mississippi River in central Dakota County. Eight memorials along the greenway will highlight our veterans, their service experience, and more!

Finally, I hope you will be able to get out to Newport Pioneer Days this weekend. You can find more information about the parade, live music, bingo, and more, on the city’s website.

New Laws Effective August 1

Many of the laws we passed this session, including universal background checks on gun purchases, combating catalytic converter thefts, worker protection and anti-discrimination laws, and more have gone into effect. You can read more here: https://buff.ly/3Dvcfhp

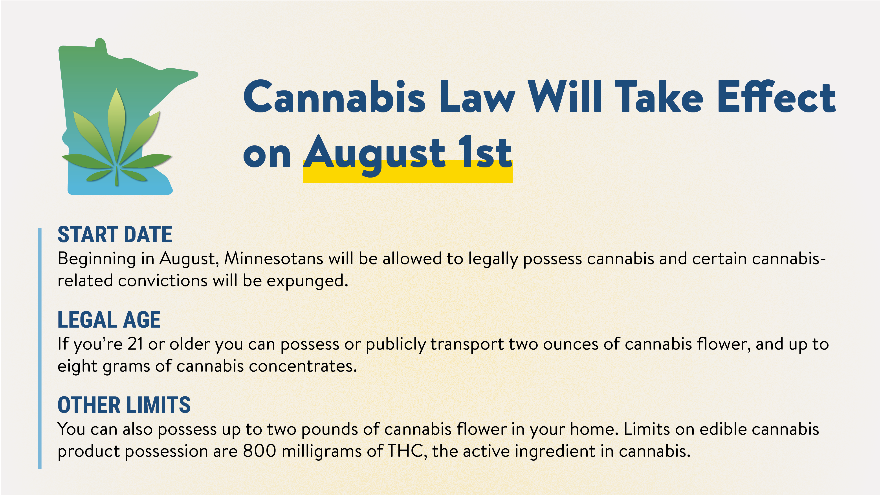

Additionally, August 1 marks the ending of the prohibition on possessing cannabis for those over the age of 21. You can learn more about the impact of that bill at the state's cannabis webpage. https://cannabis.state.mn.us/

Social Security Tax Exemption

I also wanted to provide information about the 2023 Tax Bill (HF 1938), which supports Minnesota seniors by including a full Social Security state income tax exemption for those earning less than $100,000 annually (married/joint) or $78,000 (single/head of household). As a result, about 76% of Minnesota seniors will pay no taxes on their Social Security income (up significantly from about half currently). About 321,950 tax returns would see an average tax decrease of $732.

Stay in Touch

Please continue to share your questions, ideas, and feedback throughout the year. You can reach me by email at rep.rick.hansen@house.mn.gov or by phone at 651-296-6828. You can contact my legislative assistant Sam O'Neill at 651-296-3305 or via email at samuel.oneill@house.mn.gov.

Sincerely,

Rick Hansen

State Representative