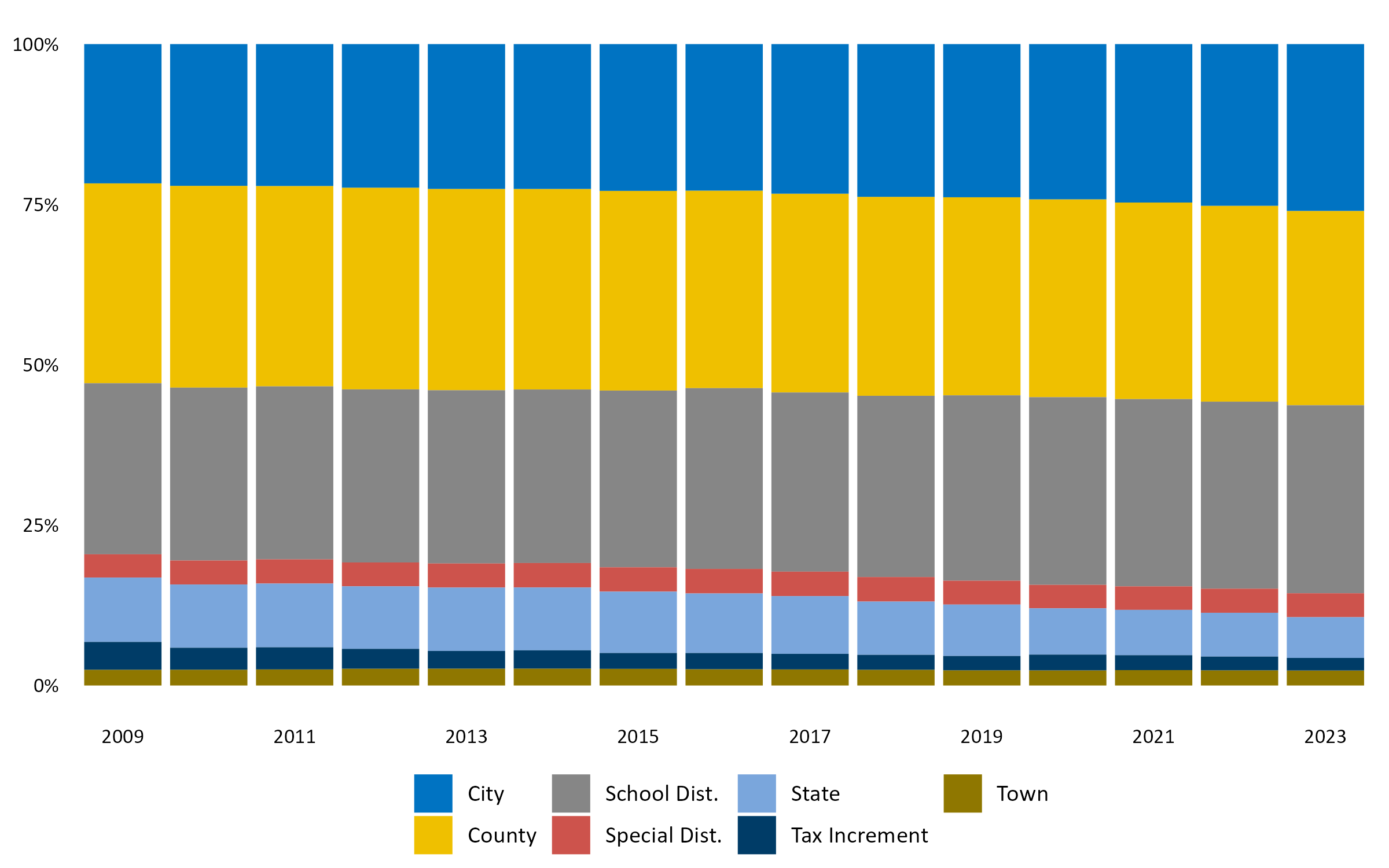

The first graph below shows each type of jurisdiction's percentage share of

the total property tax burden over the relevant time frame. The

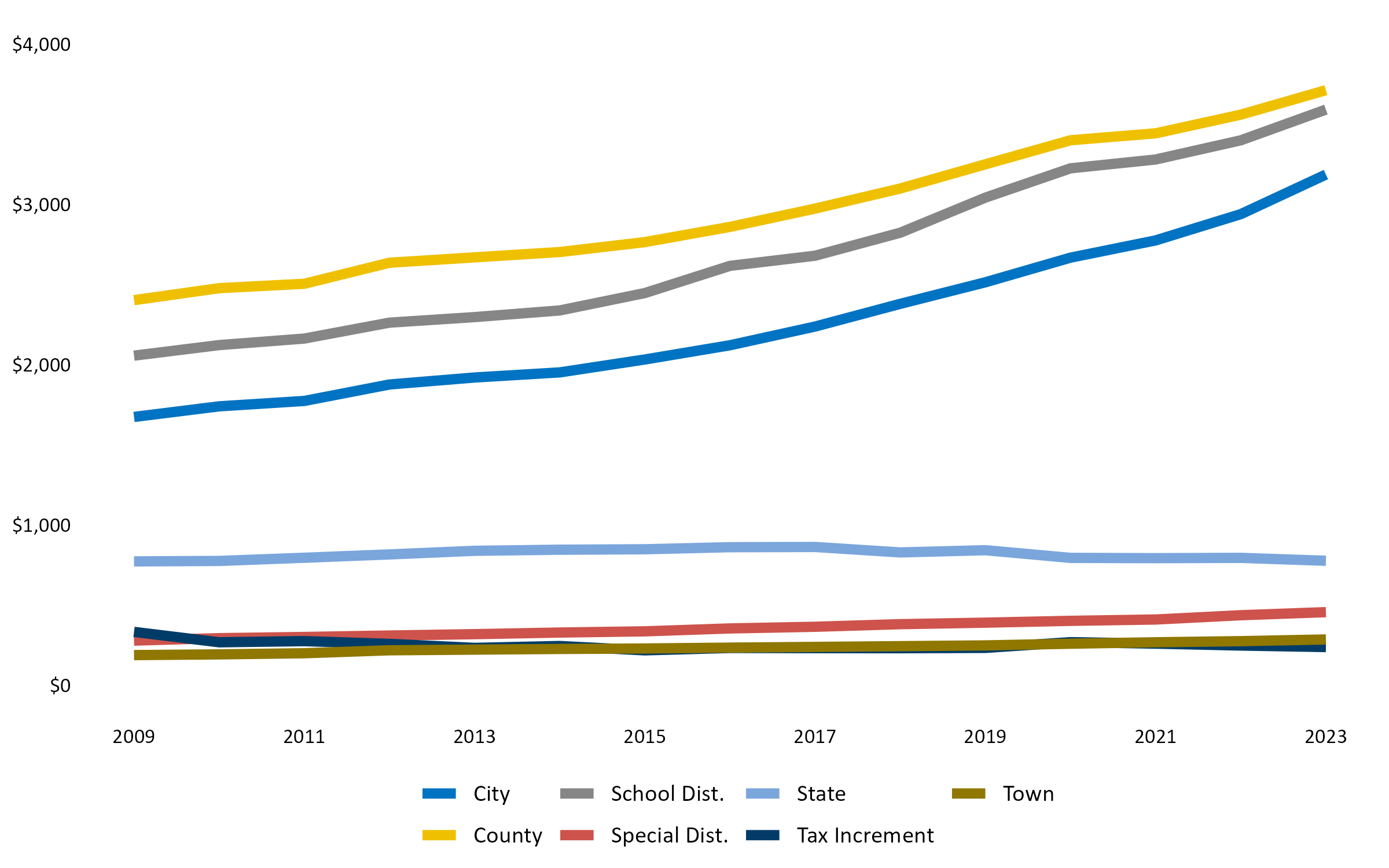

second shows the absolute amount of property taxes collected by each type of

jurisdiction. Tables containing the data underlying the

graphs follow.

Shares of Net Tax by Type of Jurisdiction

2009-2023

Note: "Special taxing districts" include all government jurisdictions other than

counties, cities, towns, and school districts with authority to levy property

taxes; they include watershed districts, housing and redevelopment authorities,

regional rail authorities, and the Metropolitan Council and other regional

government entities.

Net Tax by Type of Jurisdiction (millions)

2009-2023

Note: "Special taxing districts" include all government jurisdictions other than

counties, cities, towns, and school districts with authority to levy property

taxes; they include watershed districts, housing and redevelopment authorities,

regional rail authorities, and the Metropolitan Council and other regional

government entities.

Net Property Tax Revenues by Type of Jurisdiction (millions)

2020-2023

| Net Taxes |

Payable Year |

| 2020 |

2021 |

2022 |

2023 |

| County |

3,400 |

3,443 |

3,560 |

3,712 |

| City |

2,668 |

2,776 |

2,939 |

3,186 |

| Town |

261 |

270 |

276 |

287 |

| School District |

3,225 |

3,280 |

3,400 |

3,592 |

| Special District |

403 |

411 |

438 |

457 |

| State |

796 |

794 |

796 |

778 |

| Tax Increment |

270 |

261 |

249 |

240 |

| Total |

11,023 |

11,236 |

11,659 |

12,252 |

2017-2019

| Net Taxes |

Payable Year |

| 2017 |

2018 |

2019 |

| County |

2,974 |

3,099 |

3,250 |

| City |

2,238 |

2,380 |

2,514 |

| Town |

241 |

245 |

250 |

| School District |

2,680 |

2,824 |

3,042 |

| Special District |

366 |

382 |

392 |

| State |

864 |

830 |

844 |

| Tax Increment |

233 |

232 |

234 |

| Total |

9,596 |

9,993 |

10,527 |

2013-2016

| Net Taxes |

Payable Year |

| 2013 |

2014 |

2015 |

2016 |

| County |

2,670 |

2,703 |

2,765 |

2,859 |

| City |

1,921 |

1,953 |

2,033 |

2,122 |

| Town |

224 |

228 |

231 |

236 |

| School District |

2,297 |

2,339 |

2,447 |

2,618 |

| Special District |

320 |

330 |

338 |

356 |

| State |

840 |

847 |

850 |

863 |

| Tax Increment |

235 |

246 |

219 |

234 |

| Total |

8,506 |

8,646 |

8,883 |

9,288 |

2009-2012

| Net Taxes |

Payable Year |

| 2009 |

2010 |

2011 |

2012 |

| County |

2,403 |

2,478 |

2,505 |

2,636 |

| City |

1,675 |

1,741 |

1,775 |

1,877 |

| Town |

190 |

194 |

201 |

220 |

| School District |

2,057 |

2,123 |

2,164 |

2,263 |

| Special District |

280 |

295 |

303 |

312 |

| State |

774 |

777 |

797 |

817 |

| Tax Increment |

334 |

269 |

277 |

259 |

| Total |

7,713 |

7,877 |

8,020 |

8,384 |