House tax bill passes after critics, supporters tussle over $2 billion

Wednesday was showdown time on the House Floor as members took up the omnibus tax bill. Critics could call HF848 the bad boy bill of the session and have said the proposed $2 billion in tax relief is so high that it makes spending in other areas of the state budget nearly impossible. Supporters, however, say the proposals are long overdue and go straight to what they say is much-needed tax relief for small businesses and middle-class families.

Sponsored by Rep. Greg Davids (R-Preston), chair of the House Taxes Committee, the bill passed 74-58. It now moves to the Senate where Sen. Rod Skoe (DFL-Clearbrook) is the sponsor. Davids tagged the bill after a Journey song, “Don’t Stop Believing,’” and, throughout the floor debate, members joined in with musical references, including House Majority Leader Joyce Peppin (R-Rogers) when she rose to talk about the difference between the Republican and DFL approaches to the state budget.

“We believe the state budget should not grow faster than the family budget,” she said. “Tax, tax, spend, tax, spend, tax spend. Those are your two songs,” she said. “The choice is clear: tax and spend or the $2 billion in tax cuts.”

However, the DFL says the bill’s cost when fully phased in will set the stage for state budget deficits.

“You are setting up deficits for the foreseeable future. We will be right back to cutting education (and) hospitals,” said House Minority Leader Paul Thissen (DFL-Mpls). “This in an incredibly, incredibly irresponsible tax bill.”

He said the current surplus is a result of the DFL doing “a lot of heavy lifting to get the budget structurally balanced. You are sending us right back to deep cuts, and an inability to provide services.”

Credits and exemptions

The costliest provision in the bill, a new Minnesota personal or dependent tax exemption with a $538.6 million cost to the General Fund, would provide a tax filer with an exemption, based on income, that could total more than $500 over the next two years for a middle-class family of four, Republicans say.

Overall the omnibus tax bill puts forward several new credits and deductions including:

- $236.7 million to phase out state taxes on Social Security income;

- $130.6 million for a credit for principal and interest loan payments on student loans;

- $51.6 million for a military pension subtraction;

- $35 million for expanding the child and dependent care credit; an

- $20.3 million to make pre-kindergarten expenses eligible for subtraction and credit, including private school tuition.

The bill would encourage saving for long-term care expenses by establishing a tax-exempt savings plan. Contributions would be tax deductible, and investment earnings would be exempt from state taxes. A $200,000 contribution limit would apply to each plan participant.

Additionally, the bill would modify Minnesota’s estate tax in phases to mirror the amount of the federal exclusion. A Revenue Department analysis showed about 800 estates would benefit.

Rep. Carly Melin (DFL-Hibbing) tried unsuccessfully to remove the provision, saying that the cost is too great and comes at the expense of too many other needs in the state.

Sales and Use Tax Changes

The bill proposes to shift several transportation-related sales taxes from General Fund use to a new Transportation Stability Fund to help sustain long-term funding for road and bridge projects. Shifting these taxes would mean $401.3 million less in revenue to the General Fund over the 2016-17 biennium and $644 million in the 2018-19 biennium. The bill also provides for repeal of last biennium’s tax on digital products.

Other sales tax exemptions include:

- sales and purchases for city celebrations;

- equipment used by restaurants;

- materials and supplies for improvements to small resorts;

- sales of precious metal bullion;

- expansion of the exemption for textbook and instructional materials; and

- admission to some nonprofit events.

Property Taxes

Rep. Steve Drazkowski (R-Mazeppa) said three themes relating to property taxes needed to be addressed this session: local government spending, the “suffocating nature of farm taxes,” and statewide property taxes on commercial and industrial properties and seasonal and recreational property.

“I submit that we have a lot of good items in the bill — containing protections for the taxpayer to ensure they are looked out for with restraint,”said Drazkowski, chair of the House Property Tax and Local Government Finance Division.

The bill lays out approximately $500 million in property tax relief, with the bulk directed at modifications to the statewide general property tax on business and seasonal residential properties. Owners of commercial, industrial or seasonal property now pay a tax over and above their local property tax that goes directly to the state’s General Fund.

Rep. Ann Lenczewski, discusses one of her proposed amendments to the omnibus tax bill, HF848, during debate on the House Floor April 29. Photo by Paul Battaglia

Rep. Ann Lenczewski, discusses one of her proposed amendments to the omnibus tax bill, HF848, during debate on the House Floor April 29. Photo by Paul BattagliaInitiated in 2001, as part of major property tax reform, the tax would be phased out over six years.

For taxes payable in calendar year 2016, the first $500,000 of market value of each parcel of commercial-industrial net tax capacity would be exempt from the levy, as well as the first $250,000 of market value of each parcel of non-commercial seasonal recreation property. According to the nonpartisan House Fiscal Analysis Department, this change would mean $446.9 million less to the General Fund for the 2016-17 biennium and nearly $1 billion less in the following biennium.

Other proposed property tax provisions include:

- making permanent the $300,000 property market value tax exclusion for a surviving spouse of a disabled veteran or a service member who dies while in active service;

- allowing agricultural property whose owner lives off-site to qualify for agricultural homestead classification, under certain conditions; and

- defining wine produced by a farm winery as an agricultural product, thereby allowing all property used for producing wine on farm wineries to be classified as agricultural.

Aid and credits

One of the more controversial provisions in the bill would limit local government aid payments to three of the four cities of the first class — Minneapolis, St. Paul and Duluth — with the savings going to the General Fund.

LGA was created in 1972 as a means to even out tax disparities in the state to assure residents a certain standard of services. The formula was revised beginning in calendar year 2014 to bring funding stability to a program that had experienced volatility due to recent state fiscal shortfalls.

Drazkowski said the proposal would modify Minneapolis, St. Paul and Duluth’s aid to “112 percent of the rest of the cities in the rest of the state. They have been paid a lot more per capita than the rest of the state.”

Rep. Erik Simonson (DFL-Duluth) said he hadn't heard an acceptable answer for the cut.

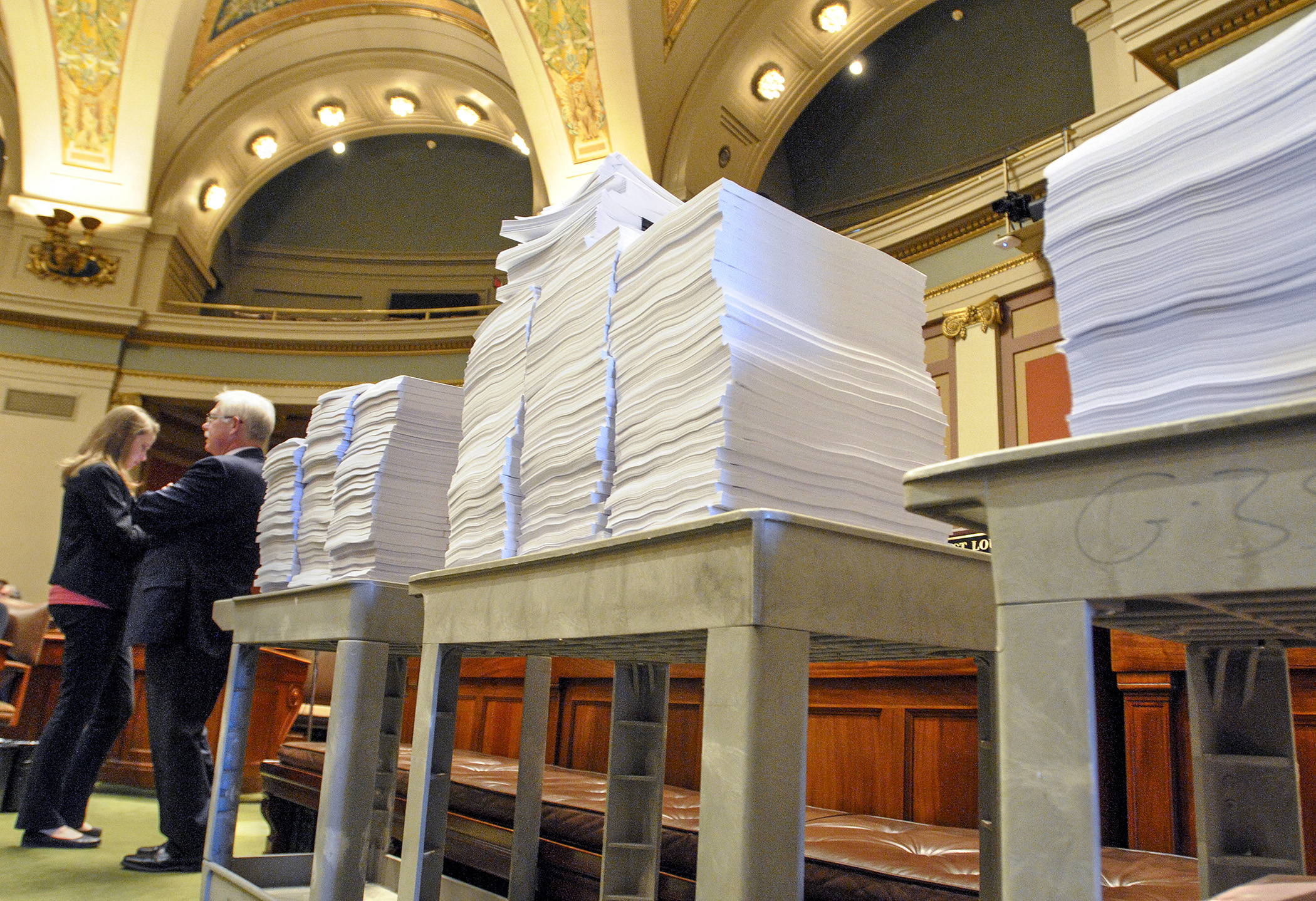

Mountains of amendments to the omnibus taxes bill required multiple carts as they awaited distribution during an April 29 recess. Photo by Andrew VonBank

Mountains of amendments to the omnibus taxes bill required multiple carts as they awaited distribution during an April 29 recess. Photo by Andrew VonBank“So what’s the real reason? This is an attack on three cities represented by Democrats.” He said the cut would mean a significant property tax increase for property owners in his community.

Owners of agricultural land would also benefit. Drazkowski said this category takes a disproportional financial hit when a school building bond is passed and then levied against district property owners. The bill would provide a property tax credit on all property classified as agricultural equal to 50 percent of the tax on the property attributable to school district bonded debt levy. That provision would mean $49.4 million less to the General Fund in the 2016-17 biennium.

More transparency for taxpayers

The Property Taxpayer Empowerment Act in the bill would provide that if a county or city with a population of 500 or more increases its property tax levy in any year, the citizens may, through a reverse referendum, petition to vote on the increase for the following year at the general election.

The provisions also would dispense with special elections for school bond referendums and many other local issues, and require them to be held on Election Day.

It would also require clear notification to taxpayers on various communications if a city or county raised its general property tax levy and were, therefore, subject to a reverse referendum.

The bill would also:

- repeal the library debt service aid to the city of Minneapolis;

- repeal the Aquatic Invasive Species Aid program;

- prohibit spending of public funds on the intercity passenger rail project between Rochester and the Twin Cities; and

- grant special taxing authority to Cottage Grove, Eagan, Wayzata, Duluth, Mankato, North Mankato, Proctor and Richfield.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Ways and Means Committee OKs proposed $512 million supplemental budget on party-line vote

By Mike Cook Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Minnesota’s projected budget surplus balloons to $3.7 billion, but fiscal pressure still looms

By Rob Hubbard Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...

Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...